how to file tax for sole proprietorship in malaysia

As the owner of a sole proprietorship you will be treated in the same way as a self-employed individual in terms of taxes. To register with the SSM you will need to first complete this form and then choose a name for your business.

Sole Proprietorship Business License Getting Started Wolters Kluwer

For Sole Prop only your own is required.

. Lets assume that Janet switches her sole proprietorship to JM in 2020. Registration as a SME. Tax file Register your LLP for a Tax File at a nearby LHDN branch.

Shop and Establishment Act. To name your business as a sole proprietorship you can either opt for. If youre a freelancer or havent registered your side gig as a business with the SSM then you would have to file under non-business income tax with the Form BE the deadline.

Here are the sole proprietorship company registration steps. Tax file Register your LLP for a Tax File at a nearby LHDN branch. You will not be able to file your income tax return unless you have obtained a PAN.

There are four steps to form the sole proprietorship in Malaysia. RM 60 If your sole prop is using a trading. RM 30 If your sole prop name is using your own name as per IC.

In order to become a taxpayer you must first register with the IRS if eligible Create a File Registration Form To obtain a copy of the Income Tax Return Form from the. Assuming that you are registered with the SSM as a sole proprietor business you will need to use B form when filing your taxes. Your companys name.

In order to register for a sole proprietorship one needs to simply follow a few steps. Obtaining a PAN card is the first step. Steps to File an Income Tax Return for a Proprietorship using eFiling.

If you earn from rental income Remember To Claim Your Rental Income Tax Exemption iMoney If you. Prime Minister Muhyiddin Yassin declared. What are the steps of starting a sole proprietorship in Malaysia.

Visit any Companies Commission of Malaysia SSM branch to complete the registration form The SSM. Tax computation for sole proprietor in Malaysia other additional sources of income. As there is no difference between the person owning the business and the business no separate tax file is needed.

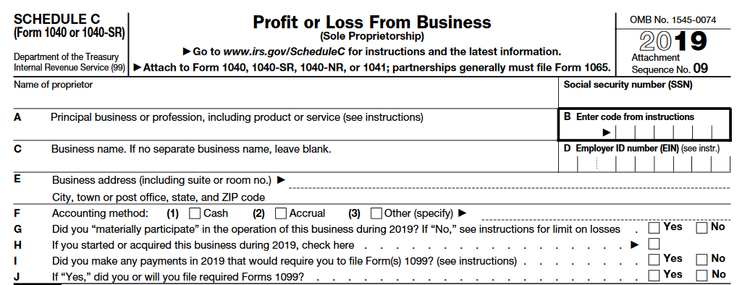

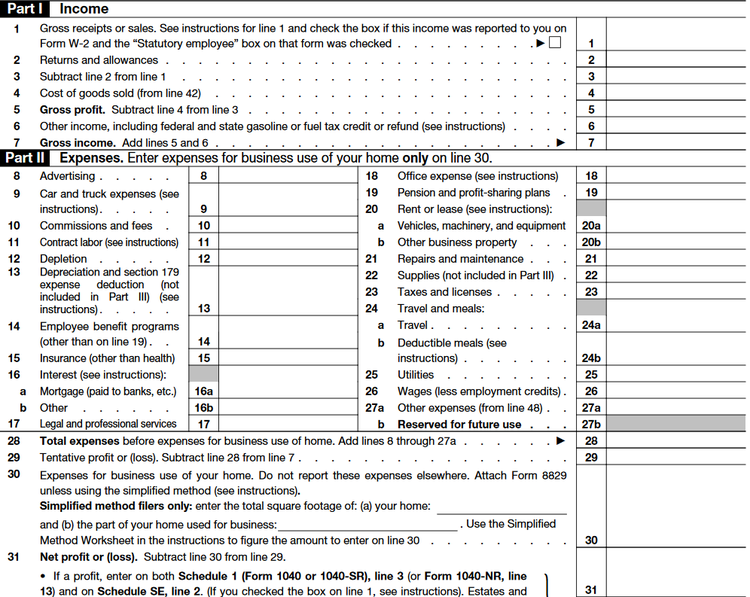

For Partnership yours and all partners. What do you need to register Sole Proprietor or Partnership in Malaysia. Youll complete a separate form for your sole proprietorship taxes Schedule C which you file with your personal income tax form Form 1040.

It must also submit the final tax return to. Complete the SSM Form A. The tax is implied on the individual income which.

The LLP must obtain closure confirmation from EPF Perkeso and LHDN. How do I close a partnership in Malaysia. As a result if you make more than 400 then you will need to pay.

How To File Income Tax In Malaysia In Malaysia the process for filing your income tax returns depends on the type of income you earn and subsequently what type of form you. For Sole Prop only your own is required. What are the steps of starting a sole proprietorship in Malaysia.

A photocopy of your IC. A sole proprietor is someone who owns an unincorporated business by himself or herself. Use Form CP 600PT.

However if you are the sole member of a domestic limited liability company LLC you are not. This is because you are now carrying on a. Youll also need to submit copies of your LLP certificate from Step 1 and stamped.

You can register for your sole proprietorship either online or in person at an SSM counter. Claim up to RM 20000 in Income Tax Rebate from PENJANA. Every taxpayer receives this card from the Internal Revenue Service.

Cash RM120 RM150 Visit the nearest SSM.

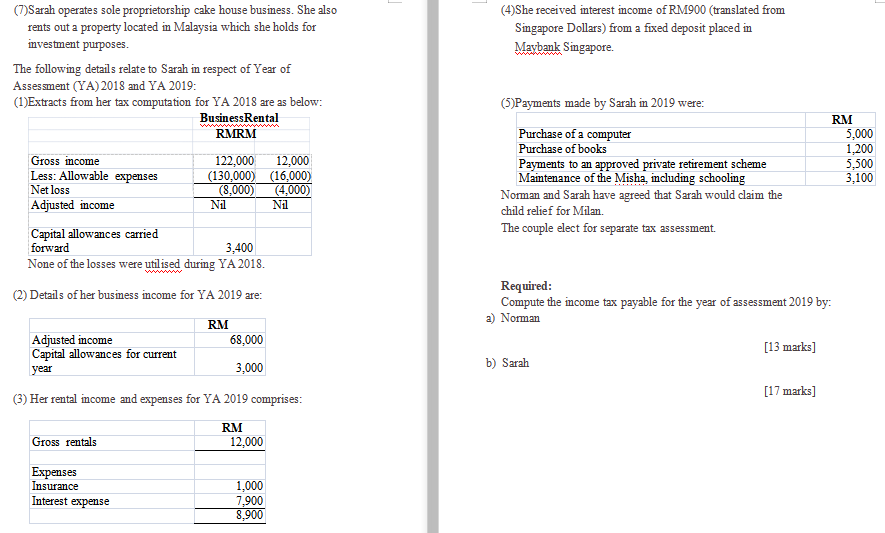

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

8 Types Of Business Entities To Register In Malaysia Foundingbird

Tax Benefit For Changing Your Sole Proprietor To An Sdn Bhd

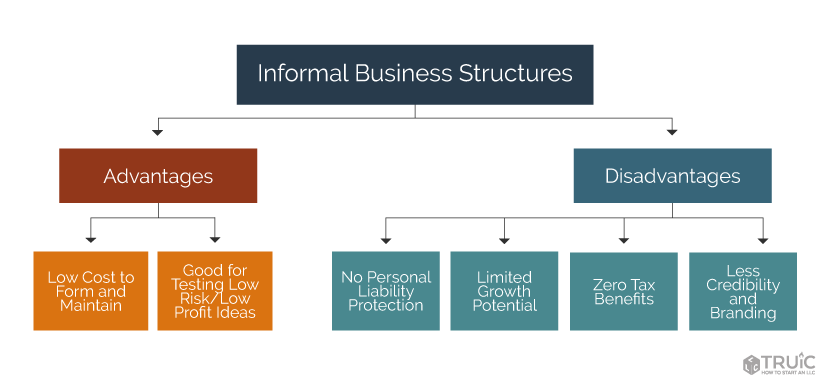

Business Structure Choosing A Business Structure Truic

/soleproprietorship-Final-dae3fba84fff43b6bde8a9472efafdd5.png)

Sole Proprietorship What It Is Pros Cons Examples Differences From An Llc

Single Member Llc Vs Sole Proprietorship Wolters Kluwer

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

5 Tips For Sole Proprietors In Malaysia Lhdn Borang B Tax Filing Youtube

How To Form An Llc Advantages Disadvantages Wolters Kluwer

What Is Sole Proprietorship In Us Advantages Of A Sole Proprietorship

Sole Proprietor Tax Forms Everything You Ll Need In 2022

Single Member Llc Vs Sole Proprietorship Wolters Kluwer

Taxplanning So You Want To Start Your Own Business The Edge Markets

Infinitus Management Advisory Sdn Bhd Calling For Sole Proprietorship Bosses Attention It S Time Again On Your Annual Exercise To Compile Past Businesses Transactions And Get The Book Keeping Accounting

What Is Dba When To File One For Your Business Wolters Kluwer

Sole Proprietorship In Malaysia

Sole Proprietor Tax Forms Everything You Ll Need In 2022

What Is A Sole Proprietorship Benefits Disadvantages How To Start Wolters Kluwer

Amini Conant Sole Proprietor Taxation Business Tax Lawyer Amini Conant

0 Response to "how to file tax for sole proprietorship in malaysia"

Post a Comment